Este artículo está disponible sólo en inglés.

Notes:

- Savings due to the reduction in expense ratios were calculated on a share class basis for each fund for which there is a Vanguard-initiated reduction. AUM as of November 30, 2024, for each relevant share class was multiplied by 2024 expense ratios. The same AUM data was then multiplied by 2025 reduced expense ratios. The difference was added across funds to determine the total estimated savings to Vanguard investors holding those funds in both 2024 and 2025.

- Vanguard Global AUM: Data as of September 30, 2024. Monetary figures are in U.S. dollars.

- VOO expense ratio: 0.03%, as of April 26, 2024.

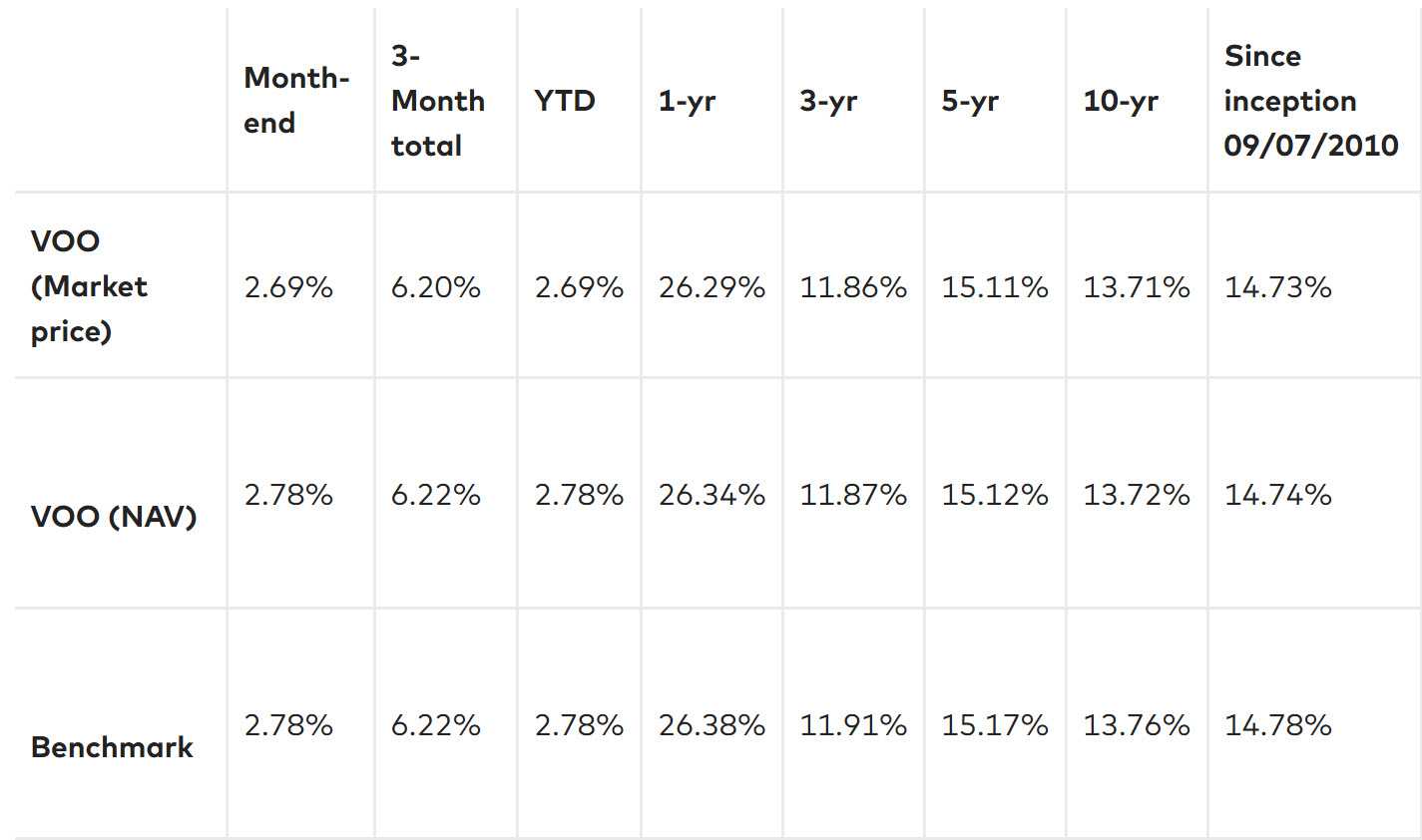

VOO standardized performance, as of December 31, 2024:

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. See performance data current to the most recent month-end.

Effective July 15, 2024, the market price returns are calculated using the official closing price as reported by the ETF's primary exchange. Prior to July 15, 2024, the market price returns were calculated using the midpoint between the bid and ask prices as of the closing time of the New York Stock Exchange (typically 4 p.m., Eastern time). The returns shown do not represent the returns you would receive if you traded shares at other times.

Important information

For more information about Vanguard funds or Vanguard ETFs, visit advisors.vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Vanguard is reducing expense ratios for certain share classes of some funds. There is no guarantee that any individual investor will save money due to the reductions in fund expense ratios. Not all fund share classes will have a reduced expense ratio and therefore not all investors will experience the estimated savings. Investors that purchase the relevant funds after the expense ratios have been reduced will not experience savings. Savings means future money not spent on expense ratios, and does not entail a rebate or deposit of any sort. Savings figures are estimates and should not be relied upon. Savings is based on data as of November 30, 2024; if other data is used, savings may differ. Estimated savings accrue to existing investors holding relevant share classes for 2024 and 2025. For illustrative purposes only. Past performance is not indicative of future results.

Vanguard does not, and will not, make any representations about whether a model portfolio is in the best interest of any investor, is not, and will not be, responsible for the determination of whether a model portfolio is in the best interests of any investor, and is not acting as an investment advisor to any investor. It is the investment advisor's responsibility to determine the appropriateness of the model portfolios, or any of the securities included therein, for any client.

The information contained herein does not constitute tax advice, and cannot be used by any person to avoid tax penalties that may be imposed under the Internal Revenue Code. Each person should consult an independent tax advisor about his/her individual situation before investing in any fund or ETF. There may be other material differences between products that must be considered prior to investing.

Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard NationalTrust Company, a federally chartered, limited-purpose trust company.

Vanguard is owned by its funds, which are owned by Vanguard's fund shareholder clients.

The sale of the VOO qualifies as a private placement pursuant to section 2 of Uruguayan law 18.627. Vanguard represents and agrees that it has not offered or sold, and will not offer or sell, any VOO to the public in Uruguay, except in circumstances which do not constitute a public offering or distribution under Uruguayan laws and regulations. Neither the VOO nor issuer are or will be registered with the Superintendency of Financial Services of the Central Bank of Uruguay to be publicly offered in Uruguay.

The VOO correspond to investment funds that are not investment funds regulated by Uruguayan law 16,774 dated 27 September 1996, as amended.