It is during these times that advisors can add tremendous value for their clients through behavioral coaching, helping clients tune out the short-term market noise and focus on their long-term investment goals. Our most recent risk speedometers show advisors have been diligent in rebalancing client portfolios during the strong equity market performance of the past few years—a discipline that is benefiting clients in 2025.

Help clients put market volatility in context

Investing can be emotionally challenging for clients, especially when their portfolio balances decline. During such times, it’s important to remind them that volatility is a natural and expected part of investing.

Consider these charts:

- Figure 1 shows U.S. equity market drawdowns since 1980, highlighting that markets have been in correction territory about 30% of the time.

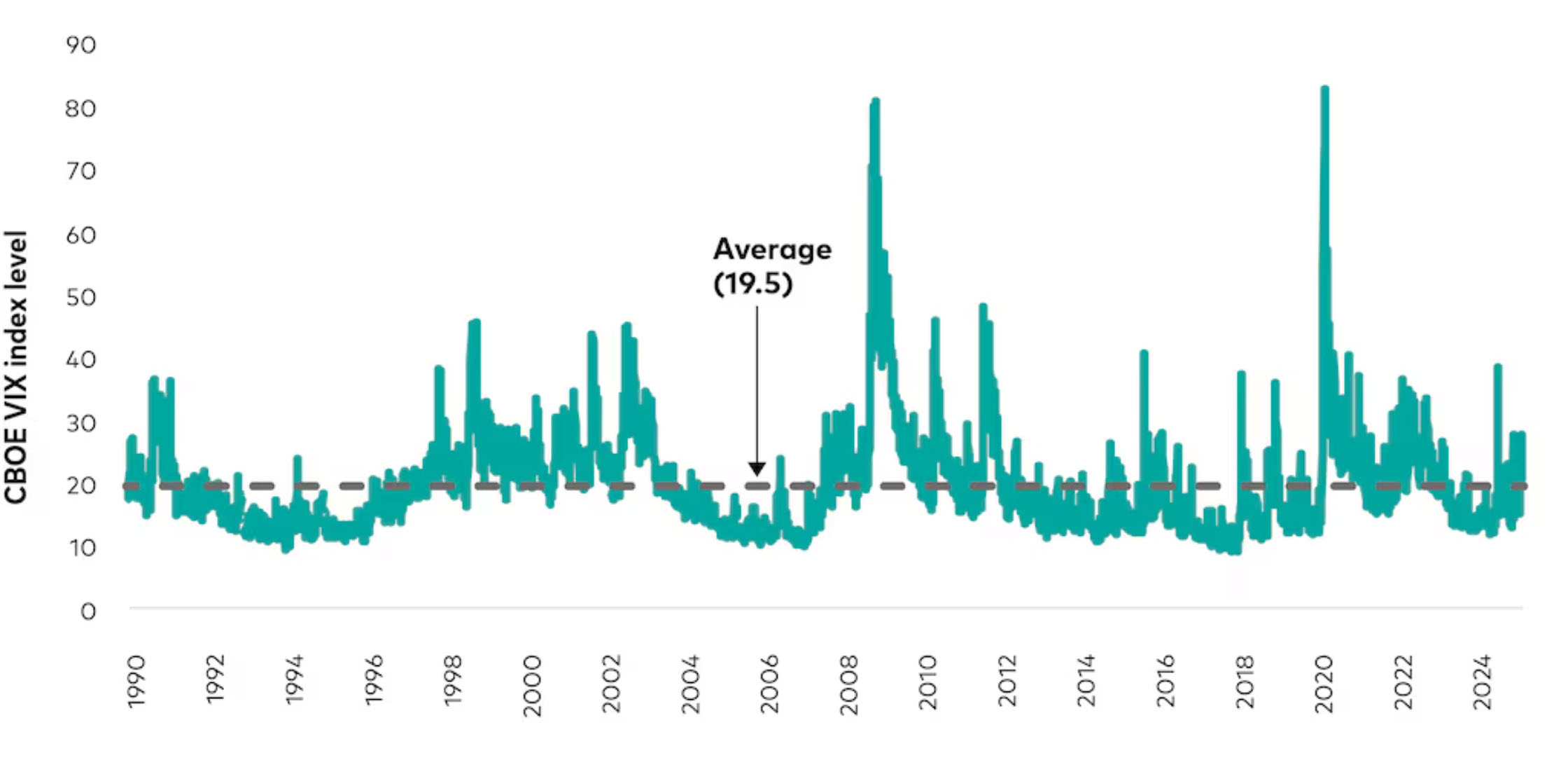

- Figure 2 shows the CBOE VIX Index which measures expected volatility.

Pairing these two charts highlights that, despite the recent pullback, expected market volatility is not substantially higher than we’ve seen historically. Sharing this type of information with your clients can help them tune out the noise and remain committed to their long-term financial plan.

Figure 1: U.S. equity drawdowns (January 1980–March 2025)

Source: Vanguard Investment Advisory Research Center using data as of March 17, 2025. Notes: Equities represented by the Wilshire 5000 Index from 1980 through April 22, 2005; the MSCI U.S. Broad Market Index from April 23, 2005, through June 2, 2013; and the CRSP U.S. Total Market Index thereafter. Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard Investment Advisory Research Center using data from CBOE as of March 18, 2025.

Use historical returns to provide more context

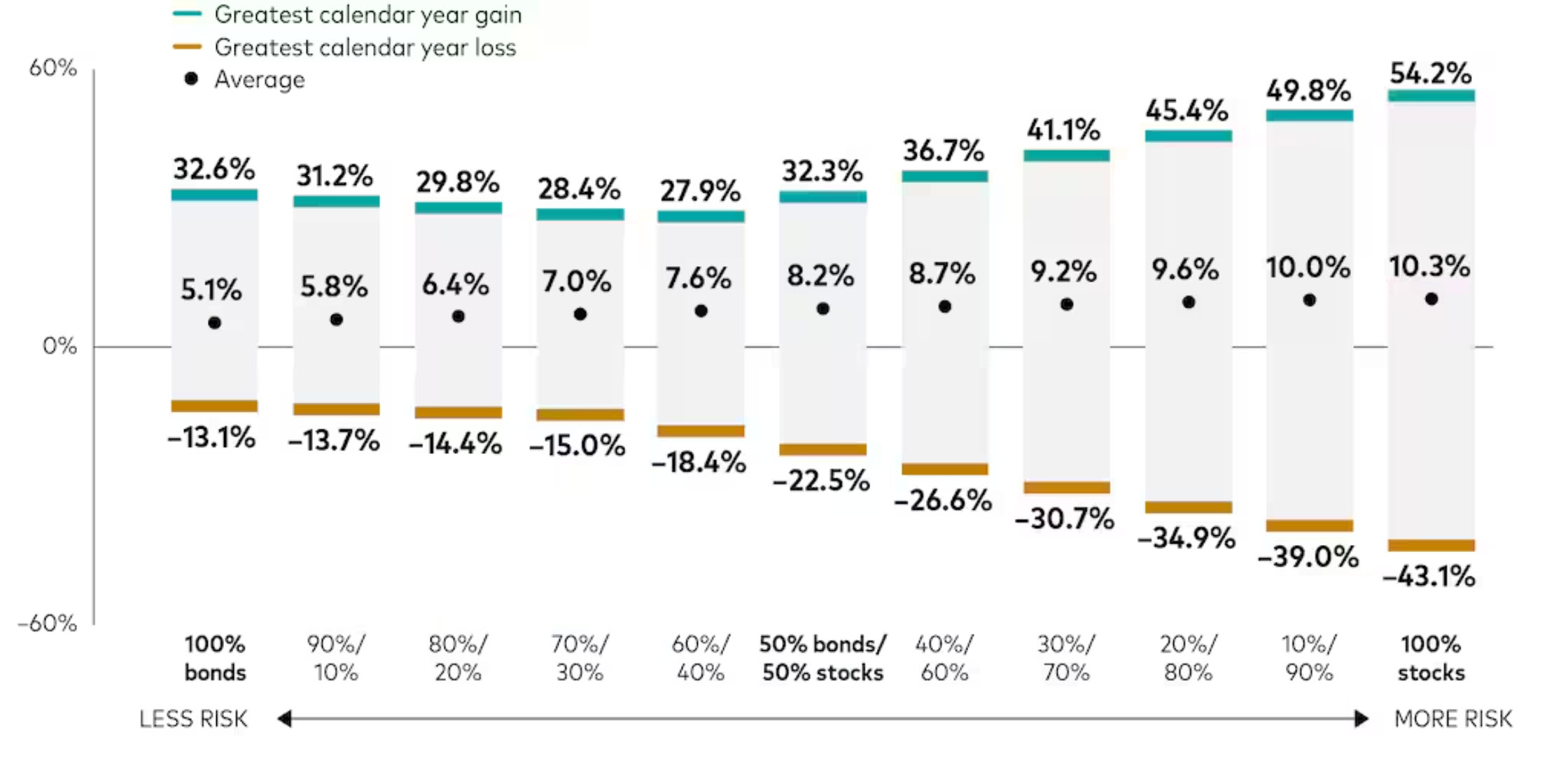

Figure 3 captures the distribution of calendar-year returns across different asset allocations, from 100% bonds to 100% equities.

Figure 3: Range of calendar year returns (1926–2024)

Source: Vanguard Investment Advisory Research Center calculations through December 31, 2024, using data from FactSet. Notes: Stocks are represented by the Standard & Poor’s 90 Index from 1926 through March 3, 1957; the S&P 500 Index from March 4, 1957, through 1974; the Wilshire 5000 Index from 1975 through April 22, 2005; the MSCI U.S. Broad Market Index from April 23, 2005, through June 2, 2013; and the CRSP U.S. Total Market Index thereafter. Bonds are represented by the S&P High Grade Corporate Index from 1926 through 1968, the Citigroup High Grade Index from 1969 through 1972, the Lehman Brothers U.S. Long Credit AA Index from 1973 through 1975, the Bloomberg U.S. Aggregate Bond Index from 1976 through 2009, and the Bloomberg U.S. Aggregate Float Adjusted Bond Index thereafter. When determining which index to use and for what period, we selected the index that we deemed to fairly represent the characteristics of the referenced market, given the available choices. Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Advisors can use such historical returns to:

- Help clients understand current market performance and set reasonable risk and return expectations for their portfolios.

- Remind clients that volatility is not an abstract event.

- Reinforce that, with a long-enough investment horizon, we should expect to see higher highs and lower lows than what we have seen in the past. For example, the worst return in the 100% fixed income allocation was –13.1% in 2022; prior to that, the worst calendar-year return was –8.1% in 1969.

The power of diversification

Diversification remains crucial in 2025, as Figure 3 underscores. Our fixed income team’s perspectives highlight the:

- Opportunities in fixed income.

- Role fixed income plays in a broadly diversified portfolio aligned with clients’ long-term investment goals.

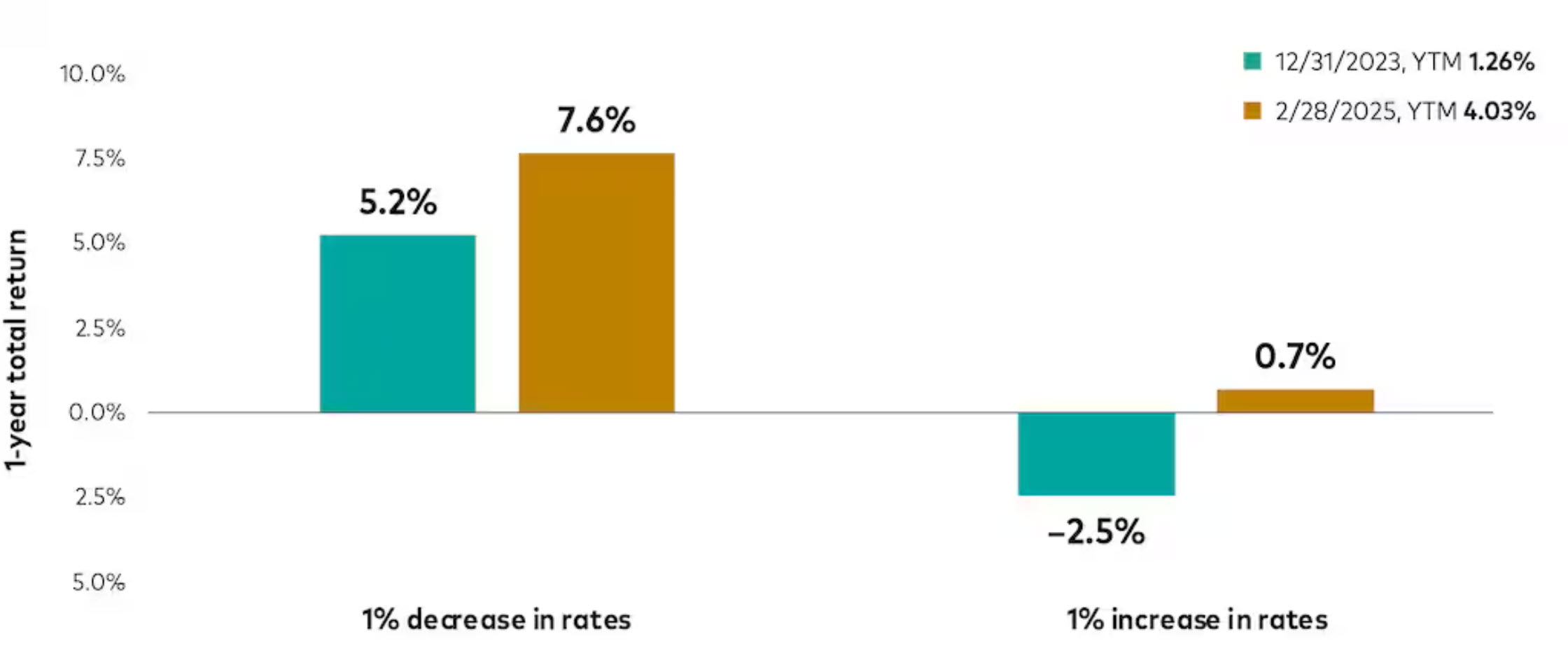

As previously mentioned, 2022 was a challenging year for fixed income investors, and may still be fresh in many of your clients’ minds; however, it might help to remind them that current starting yields are higher, providing them with a “coupon wall.” This implies that, compared with a few years ago, future bond returns are less likely to be affected by minor interest rate increases.

History has taught us that it’s hard to predict rate changes. But even a sudden 1% change at the five-year point on the curve will likely make clients’ results better in the next year, as shown in Figure 4. This chart compares the forward one-year total returns of a 1% increase or decrease in rates on the on-the-run 5-year Treasury on December 31, 2021, and February 28, 2025. This shows that the higher starting yield on bonds today leads to the dual benefits of:

- A higher total return if rates decrease.

- A yield buffer because of the higher starting yield if rates increase.

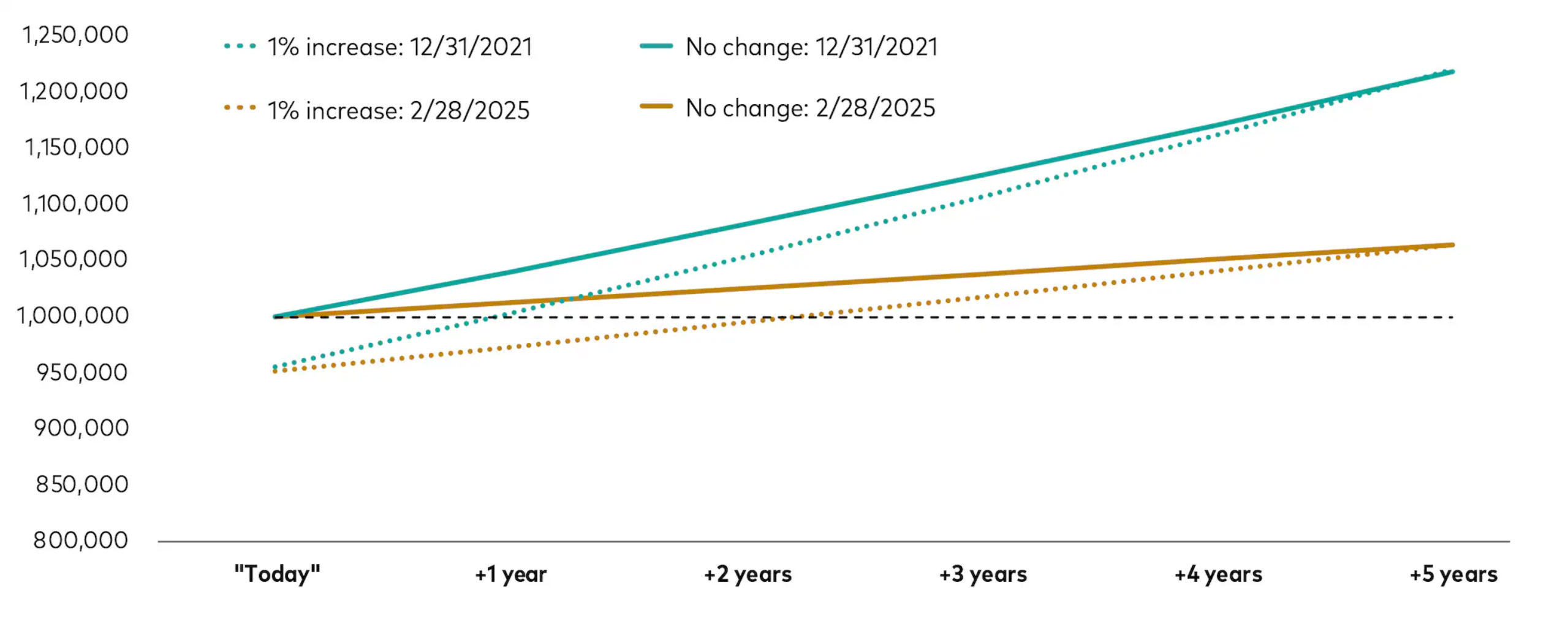

Figure 5 also highlights that while a sudden increase in rates of 1% would cause similar negative initial price moves, the current higher yield on 5-year Treasuries would overcome that price loss in less than a year, significantly better than a few short years ago.

Figure 4: Effect of 1% change in rates on 5-year Treasuries’ 1-year total returns

Sources: Vanguard Investment Advisory Research Center calculations using data from Morningstar Direct and St. Louis FRED database. Notes: Modified duration calculated using 5-year constant maturity yields as of December 31, 2021, and February 28, 2025. Changes in rates assumed to impact the price of the bonds immediately and assumes that the change in rates is the same across the entire yield curve. Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Figure 5: Effect of 1% increase in rates on 5-year Treasuries now versus 3 years ago

Sources: Vanguard Investment Advisory Research Center calculations using data from Morningstar Direct and St. Louis FRED database. Notes: Modified duration calculated using 5-year constant maturity yields as of December 31, 2021, and February 28, 2005. Changes in rates assumed to impact the price of the bonds immediately "today" and assumes that the change in rates is the same across the entire yield curve. Past performance is not a guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

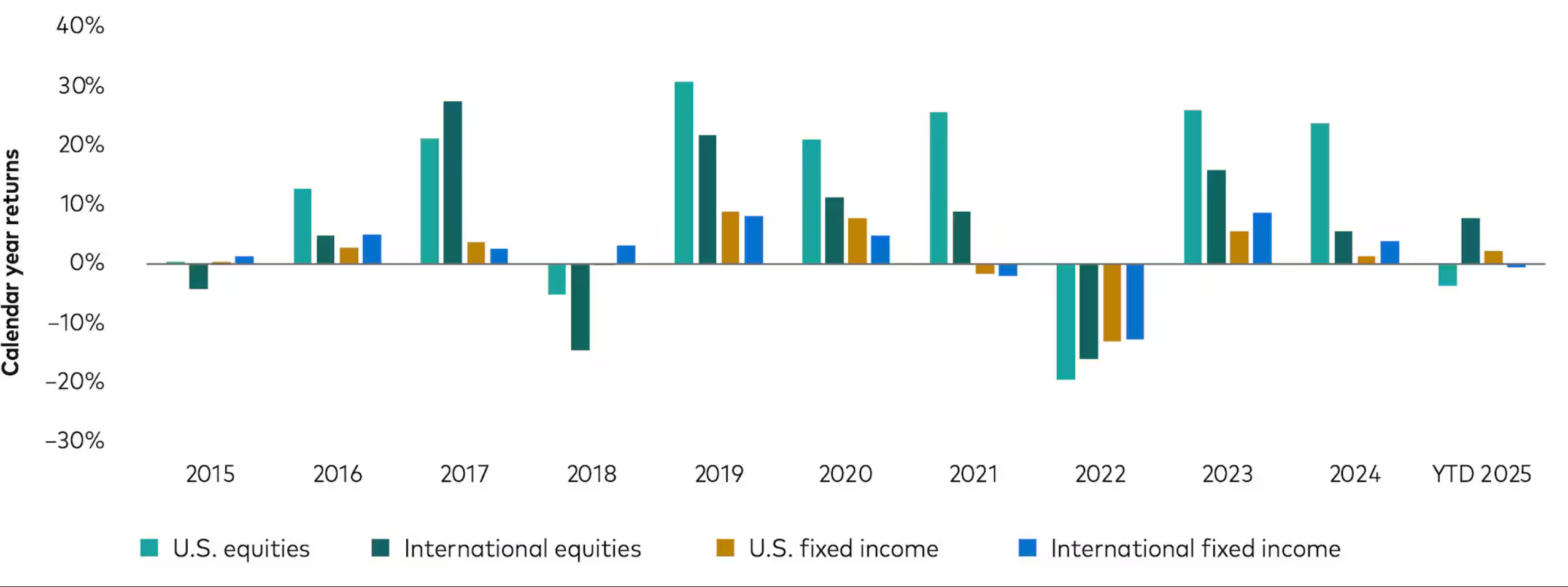

Diversification extends beyond fixed income. As Figure 6 illustrates, consider international exposures as well. In recent years, non-U.S. equities have faced relative performance challenges because of the dominance of the Magnificent 8 in the U.S. However, while the rest of 2025 remains uncertain, clients invested in non-U.S. equities have benefitted from their relative performance year-to-date.

Figure 6: Calendar-year returns for U.S. and non-U.S. equities and fixed income (2015–2025 YTD)

Source: Vanguard Investment Advisory Research Center calculations using data as of March 17, 2025. Notes: U.S. Stocks are represented by CRSP U.S. Total Market Index, International Stocks represented by FTSE Global All Cap ex U.S. Index, U.S. Bonds are represented by the Bloomberg U.S. Aggregate Float Adjusted Bond Index, and International Bonds represented by the Bloomberg Global Aggregate ex-USD Index Float Adjusted RIC Capped USD Hedged Index. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Advisor’s Alpha is enduring

We designed our Advisor’s Alpha 3B mental model to help advisors and clients tune out the noise during inevitable periods of market volatility. Advisors who use this model tend to build stronger client relationships, reduce stress, and enhance the long-term investment success of their clients and their practice. While market volatility is inevitable, the value that advisors provide in guiding clients through these turbulent times is both enduring and invaluable.

For more information, check out the wide range of resources in the Advisors Alpha section of our website, or contact your sales executive.

All investing is subject to risk, including the possible loss of principal.

Notes:

Bloomberg® and Bloomberg Indexes mentioned herein are service marks of Bloomberg Finance LP and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Vanguard. Bloomberg is not affiliated with Vanguard and Bloomberg does not approve, endorse, review, or recommend the Financial Products included in this document. Bloomberg does not guarantee the timeliness, accurateness or completeness of any data or information related to the Financial Products included in this document.

Vanguard Mexico is not responsible for and does not prepare, edit, or endorse the content, advertising, products, or other materials on or available from any website owned or operated by a third party that may be linked to this email/document via hyperlink. The fact that Vanguard Mexico has provided a link to a third party's website does not constitute an implicit or explicit endorsement, authorization, sponsorship, or affiliation by Vanguard with respect to such website, its content, its owners, providers, or services. You shall use any such third-party content at your own risk and Vanguard Mexico is not liable for any loss or damage that you may suffer by using third party websites or any content, advertising, products, or other materials in connection therewith.